Topic Archives: Beer Legislation

BEER Act Introduced

Senators John Kerry (D-Massachusetts)& Mike Crapo (R- Idaho) have officially introduced the BEER Act, that would lower the beer excise tax on small brewers in America. BEER stands for Brewer’s Employment & Excise Relief.

Senators John Kerry (D-Massachusetts)& Mike Crapo (R- Idaho) have officially introduced the BEER Act, that would lower the beer excise tax on small brewers in America. BEER stands for Brewer’s Employment & Excise Relief.

What You Need To Know:

The BEER Act aims to create close to 1,600 jobs in the small brewing industry. There are close to 100,000 jobs already in craft brewing. The senators have met with breweries in their respective states discussing finances, supply & demand, taxation etc. Introducing this beer will keep the industry thriving in rough economic times. Small brewers incur higher costs for production, raw materials, & packaging than the large breweries, and multi-national competitors. The BEER Act also stimulates barley, wheat, & hop growers.

Current Tax Structure:

– If the small brewery produces less than 2 million barrels, the excise tax is $7 a barrel on the first 60,000 barrels

– Over 60,000, excise tax is $18 a barrel.

Proposed Tax Structure:

– Reduces the excise tax from $7 to $3.50. The difference gives small breweries an estimated $19.9 Million for expansion & employment.

– Excise tax for barrel production from 60,000 barrels t0 2 million barrels would be lowered to $16 a barrel. An addition of $27.1 million for growth & development.

The current tax structure and legislation has not been updated since 1976.

Full Press Release:

(Washington, D.C.) — Senators Mike Crapo (R-Idaho) and John Kerry (D-Massachusetts) today introduced legislation to reduce the beer excise tax for America’s small brewers. The Brewer’s Employment and Excise Relief (BEER) Act will help create jobs at more than 1,600 small breweries nationwide, which collectively employ nearly 100,000 people. Idaho and Massachusetts are home to dozens of small breweries.

“Like any private business, craft brewing is all about supply and demand,” said Crapo. “In touring Idaho last year, I met with many craft brewers who are seeking to expand their business because they are seeing increased demand for their product. In addition, this legislation will expand the ready markets for our barley, wheat and hops producers in Idaho. I remain optimistic this bill will pass this year to create new jobs and new markets.”

“The craft beer revolution started right here in Massachusetts and they’ve been going toe to toe with multi-national beer companies ever since,” said Kerry. “This bill will help ensure that these small businesses keep people on the payroll and create jobs even during tight economic times.”

Because of differences in economies of scale, small brewers have higher costs for production, raw materials, packaging and market entry than larger, well-established multi-national competitors. The BEER Act also helps states that produce barley, hops and other ingredients used by these small brewers. In addition to Senators Crapo and Kerry, the legislation is co-sponsored by a bipartisan coalition of 16 additional Senators.

Currently, a small brewer that produces less than two million barrels of beer per year is eligible to pay $7.00 per barrel on the first 60,000 barrels produced each year. This legislation will reduce this rate to $3.50 per barrel, giving our nation’s smallest brewers approximately $19.9 million per year to expand and generate jobs. This change helps approximately 1,525 breweries nationwide.

Currently, once production exceeds 60,000 barrels, a small brewer must pay the same $18 per barrel excise tax rate that the largest brewer pays while producing more than 100 million barrels. This legislation will lower the tax rate to $16 per barrel on beer production above 60,000 barrels, up to two million barrels, providing small brewers with an additional $27.1 million per year that can be used to support significant long-term investments and create jobs by growing their businesses on a regional or national scale.

The small brewer tax rate was established in 1976 and has never been updated. This legislation would update the ceiling defining small breweries by increasing it from two million barrels to six million barrels. Raising the ceiling to six million barrels more accurately reflects the intent of the original differentiation between large and small brewers in the U.S.

Georgia Still Pushing For Sunday Sales

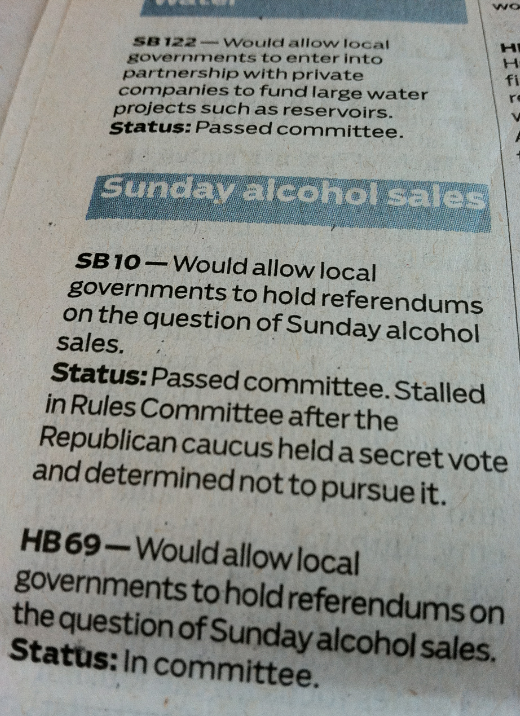

GEORGIA – Published in the Atlanta Journal Constitution today was the state of Sunday Sales in Georgia. The bill still isn’t dead, just stalled.

GEORGIA – Published in the Atlanta Journal Constitution today was the state of Sunday Sales in Georgia. The bill still isn’t dead, just stalled.

What You Need To Know:

– There are 2 bills up for vote, one in the House (HB 69), one in the Senate (SB 10)

– The Senate bill has stalled in the Rules committee Mid February.

– Republican Caucus held a secret vote, opting not to bring the bill to the floor for a vote.

– The House Bill actually passed the committee, but hasn’t reached the floor for a vote.

There are some interesting discussions on constitutionality of the situation and more.

Read The Access Atlanta Article Here —> blogs.ajc.com

AJC Sunday Sales Update

Sunday Sales Opponent: Jerry Luguire

Dissecting the opposition to the Sunday sales bill in Georgia requires talking about this individual – Jerry Luguire. Luguire is the president of Georgia’s Christian Coalition, backed by the Georgia Baptist Convention. He leads the charge against the passage of Sunday sales in Georgia.

Dissecting the opposition to the Sunday sales bill in Georgia requires talking about this individual – Jerry Luguire. Luguire is the president of Georgia’s Christian Coalition, backed by the Georgia Baptist Convention. He leads the charge against the passage of Sunday sales in Georgia.

Jerry Luguire is 72 year old resident of Columbus, Georgia. He gave up drinking 31 years ago. Some of his quotes on the matter:

“There ought to be at least 1 day a week that Georgians are not allowed to buy alcohol”

Judging by his replies to those who oppose him, reeks of arrogance. Taking a quote from Neil Boortz’s blog, an individual posted a comment:

“Your branch has been very vocal in using the legislative power of government to keep an antiquated rule in place which forbids the sale of alcohol in stores. As a Christian, I find this very offensive, and I don’t believe that we should force our principles or beliefs upon anyone. I can only imagine what all of my non-Christian friends think as they watch your branch try to force this law upon the citizens of Georgia. I’d like someone to respond to me to let me know exactly why this is such an important issue to your organization, and why you feel the need to support such an action.”

His reply:

“Maybe you should find some Christian friends.”

As a Christian person myself, I find that offensive. Regardless, his pressure on Georgia lawmakers seems to be paying off.

His contact info – [email protected]. Writing to him won’t change his mind, but will most likely get a snide, arrogant response.

Links on Luguire —> Neil Boortz, Ledger – Inquirer

Pic credit: Ledge – Inquirer

Sunday Sales Rally Planned Today

Today at 12 noon, supporters of S.B. 10 aka Sunday sales bill will rally at the capitol building in downtown Atlanta. Last week, the bill was not brought to a vote due to “lack of support”. Special interest groups have pressured Georgia lawmakers not to bring the bill to vote.

Today at 12 noon, supporters of S.B. 10 aka Sunday sales bill will rally at the capitol building in downtown Atlanta. Last week, the bill was not brought to a vote due to “lack of support”. Special interest groups have pressured Georgia lawmakers not to bring the bill to vote.

Today supporters rally to show lawmakers there is support for this bill. Georgia is the last of 3 states that banned on premise sales of beer & wine.

Read the press release about the rally here —> Rally Press Release

See you at the capitol at noon!

Surly Brewing Asks For Help

Last week Surly Brewing (Brooklyn Center, MN) announced that in their 5th year, they plan to expand big time. Great news for beer lovers in Minnesota and far.

Last week Surly Brewing (Brooklyn Center, MN) announced that in their 5th year, they plan to expand big time. Great news for beer lovers in Minnesota and far.

As if it weren’t hard enough to be a successful craft brewer, and then raise the massive amounts of money to expand your brewery – the government has silly laws that stifle your growth and your industry. Surly Brewing even came out and said that they would do anything they could to work with lawmakers to make this new venture successful. Lawmakers however, basically retorted with – go build somewhere else. So Surly is asking for you the beer drinker’s help.

What a week! The news that we are planning to build a new destination brewery has had an amazing response. The ranks of the Surly Nation have grown and we are humbled by all of your encouragement. THANK YOU.

But as you know, not quite everybody is in favor of what we want to do. The bill has not yet been introduced but already there is stiff opposition, with some people telling us we should go to another state and build. We don’t see that as an option right now so we need YOUR help!

Surly Brewing is calling on YOU to make sure state legislators know there is public support behind Surly’s effort to allow Minnesota brewers to apply for a license to SELL GLASSES OF THEIR OWN BEER at the brewery.

We are asking you to contact your state Representative and state Senator to let them know you support the Surly expansion— and the law change that’s needed to make it happen. Here’s how you can help:

Click this link and enter your address to find your state Representative and state Senator: http://www.gis.leg.mn/OpenLayers/districts/

Email/Call your state Representative and state Senator (contact only YOUR district’s legislators)

Tell them you’re a Surly fan and you support the proposal to allow Surly to sell glasses of THEIR beer at THEIR brewery. Ask your legislators to join you in support of Surly and Minnesota’s other craft breweries.

If you call, it’s likely you’ll get voicemail or be asked to leave a message with your legislator’s assistant, which is just fine. And it’s ok to be passionate but remember to mind your manners. We’re trying to win these folks over to the Surly cause.

Tell your family and friends to support the proposal and contact their state legislators too!

THE LATEST

Since we announced our plans for the Surly Destination Brewery project last week, there’s been a lot of interest and excitement. But, there’s also been a lot of misinformation so we wanted to clarify what we are working toward and formally ask for your help.

WE ARE A SMALL BUSINESS WITH A BIG IDEA: We want to build a brewery that includes a restaurant, bar, beer garden, and event center, which will make it a destination for craft beer fans in Minnesota and across the country. The destination brewery will be another Twin Cities amenity.

WE ARE NOT LOOKING TO TEAR DOWN THE “THREE-TIER SYSTEM”: Right now we self-distribute our beer, but with the new brewery we are going to give that up and will therefore hire a Minnesota distributor.

WE ONLY WANT TO SELL OUR GLASSES OF BEER AND ONLY AT THE BREWERY: We don’t want to sell liquor, wine, or another brewery’s beer. And we aren’t looking to have multiple locations — just one location, at the brewery.

WE DON’T WANT TO SELL OUR PACKAGED BEERS: We don’t want to sell growlers, cans, or bottles at the new brewery.

WE ARE A PROUD MINNESOTA COMPANY: Some in the opposition have suggested that we build our destination brewery in another state, where the laws are more accommodating. While it’s true that we could get this brewery built in many other states, we don’t see that as an option right now. We want to build it in Minnesota–we are a Minnesota company and would like to keep it that way. Some of the country’s hottest craft beer brands have breweries in their states similar to the one we are proposing.

WE ARE WORKING TO FIND A SOLUTION: This a whole new world for us and it has proven to be an uphill climb to update the law so we can continue to grow our business the way we want to. But we DO want to meet with the opposition to find a resolution. Our destination brewery will benefit Minnesota in many ways.

MINNESOTA IS A BEER STATE: Other states, such as Colorado, Wisconsin, California, and Oregon are seen as notable beer states and have breweries like the one we are proposing. They attract tourists, which helps other local businesses, including hotels, bars/restaurants and transportation. Beer tourism is becoming more and more popular. In fact, Surly founder Omar Ansari and his wife came up with the concept of Surly on a four-day beer trip to Oregon. And, the New York Times recently featured a beer trip one of its writers took to Northern Minnesota, which further confirms that these trips and craft beer are more popular than ever.

Thanks for your continued support. Now’s the time to connect with your friends, family and co-workers to help keep our proposal moving forward. Keep following us on Twitter (www.twitter.com/surlybrewing) and Facebook (http://on.fb.me/4I71Pj) for more news and ways you can help.

THANK YOU!

Omar Ansari

Founder of Surly Brewing