Headlines

Auburn University & New Realm brew up a Master’s Degree in beer

America isn’t short on breweries, and for that matter, brewers. What it does lack is a clear way to become a professional brewer- or even a highly trained one. If you think about it, there are nearly 10,000 breweries in the United States and only handful of professional brewing programs. Some of the biggest names being Siebel and UC Davis. Now the Southeastern Conference can claim more than just football dominance.

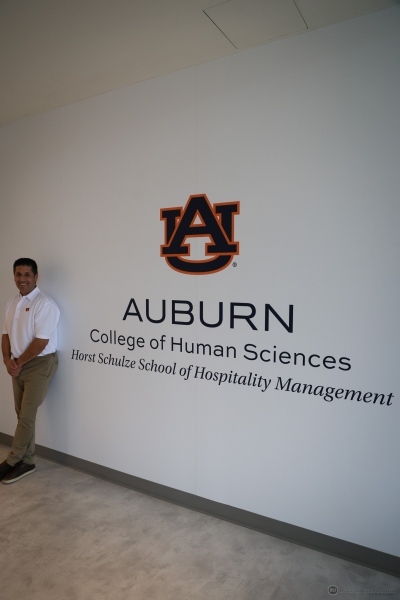

Auburn University initially offered a Master’s Certificate in brewing science, which has now grown into a full blown Brewing Science and Operations, Master’s of Science Program. And they are doing it with the help of New Realm Brewing Company.

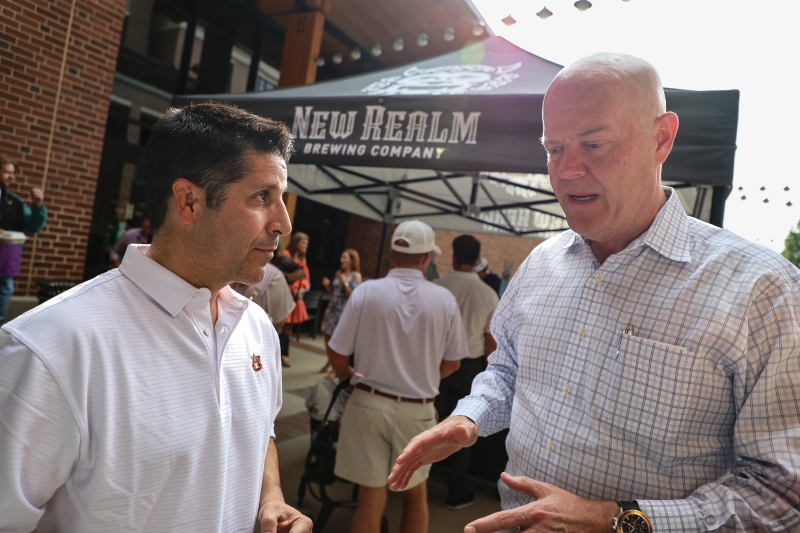

To get better at anything you have to learn. Read more on the topic. Do your research. In brewing it’s not that easy. Apprenticeships are impossible to come by, and simply brewing in a bucket in your garage won’t put you on the brew deck at Sierra Nevada, or Firestone Walker, much less your local brewpub. You need science, as much as practical training. New Realm co-founder Carey Falcone knows this, and when this educational partnership came up, he jumped at the chance.

Calling it a partnership doesn’t do this program justice. This goes beyond textbooks and lectures on brewing science. New Realm built a full 7-barrel commercial brewhouse and taproom open to the public, quite literally on campus. Going as far as changing the city’s licensing laws to do it. Craft beer in America doesn’t get simply get better by brewing it or having more breweries, it becomes world class with more classically trained brewers standing over boil kettles coast to coast.

Perhaps that’s the most interesting piece is why New Realm did this at all. A 7-barrel brewery on a college campus isn’t a financial move. Sure, it’s branding but in reality, it’s an investment in future of craft beer. After all, we all want great beer, and most of us just assume it will be waiting for us the next time we go to the bar.

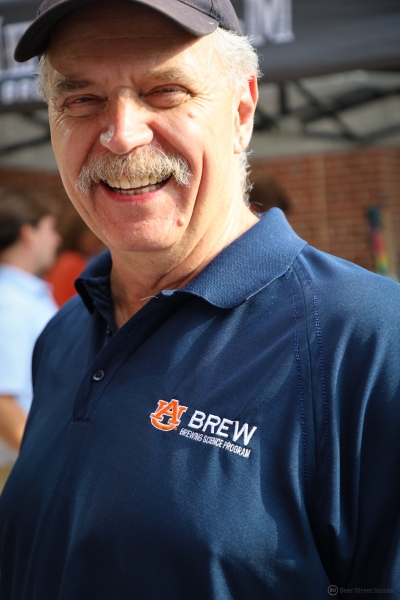

Drew Kostic heads up not only the brewing operations at New Realm Auburn, but lectures within the program. Kostic went to law school at Duke and eventually became a lawyer in New York City. It’s safe to say he didn’t enjoy it. While in a federal clerkship, Kostic started pursuing a master’s certificate in brewing operations at Auburn. “My passion was beer and brewing, and I don’t think could ever go back to law,” Kostic says. After brewing at Circa Brewing and Oskar Blues, years later Kostic found his way back to Auburn where his brewing career started, actually brewing on-campus, and teaching as Affiliate Faculty in this Master’s program.

Falcone called me in June of 2023 to talk about Auburn and this new found partnership. Something stood out to me in that call – at no point did Carey ever once talk about what the involvement in this program could do for him or the brewery – only what Auburn and this Master’s program could do for for beer. Sentiments Kostic echos repeatedly in his passion for this program.

“Educated Creativity”

The days are quickly fading where brewers would just dump adjuncts into a brew or throw hops at the wall and see what sticks. Kostic and “AU Brew” are fostering “Educated Creativity” within their Masters program. “We are teaching a balance between science and creativity so you brew better and smarter,” Kostic says. Technology is aiding in this mission as well, allowing students and brewers to learn the business and science of beer pretty much anywhere.

AU Brew, is a part of the Tony and Libba Rane Culinary Science Center, which is home to the brewing science program, Trinchero Estates Wine Appreciate Laboratory, Distilled Spirits Laboratory, Culinary Science, Event Management, and Hotel and Restaurant Management. All a part of Auburn University’s multi-million dollar investment in a world class approach to hospitality, food and beverage management high education.

AU Brew is a game changer for those seeking a higher education in craft brewing. Falcone leads the brewery not by tell you what you have to do, but asking what prevents you from succeeding.

Perhaps this program does just that.

Tombstone Pizza creates pizza flavored beer with New Belgium

Tombstone Pizza has teamed up with New Belgium to create a limited edition Voodoo Ranger Pizza Beer for National Pizza Day April 7th.

Tombstone Pizza is a frozen staple in freezers across America. We’ve put down hundreds over the years after a night of drinking. We’re pretty sure Tombstone knows and now wants in on the beer action too. Introducing Voodoo Ranger IPizzaA.

Yes, we have an IPA that tastes like pizza. Actually, according to Tombstone’s PR company, they tell us the beer is a New Belgium Voodoo Ranger IPA base, brewed with tomato powder, oregano extract and “other natural flavors.” Per the company, “this brew is a blend of all the flavors of a pizza (a crispy crust, tangy tomato sauce, savory herbs and spices, with a finishing pepperoni kick of heat.) So basically a hoppy pizza.

The finishing pepperoni kick of heat will make you reach for another slice… or another pint.

IPizzaA Beer debuts on National Pizza Day on April 7th, which is ironically not March 14 (3.14) for a very limited time for $49.99 per 4-pack in un-named select markets. If that price is too steep for you, feel free to sign up for a free 4-pack of the beer and forthcoming new Tombstone Pizza flavor here from now until launch day.

Style: IPA (w/ Tomato Powder. Oregano Powder.)

Availability: 16oz Cans. Limited Release.

Debut: 4/7/24

7% ABV

Wooden Robot co-founder dies in brewery fall

The co-founder of Charlotte, North Carolina’s Wooden Robot Brewery died in a fall at the South End location on February 20th.

Earlier today, Charlotte, North Carolina’s Wooden Robot Brewery announced that both taprooms would be temporarily closed due to unforeseen circumstances. Later it was announced that co-founder Dan Wade died in a fall at the brewery’s South End location.

According to various news sources, the fall was reported between 2-3:30 pm EST.

Brewery co-founder Josh Patton issued a statement via Instagram:

It is with an extremely sad and heavy heart that we share this news. Due to an accident that occurred today, we lost one of our founders, co-owners, and friend, Dan.

We ask that you respect the privacy of his loved ones in this incredibly difficult time. We are all still in shock and need time to process everything, but we will do our best to keep everyone in the loop for when we open up our taprooms again.

Your thoughts and prayers for Dan’s family, his wife, and his son are much appreciated at this time.

– Josh

The South End location opened in June 2015. The NoDa location opened in 2019.

Ed Note: We at Beer Street Journal send our deepest condolences to both Dan’s family and the brewery family. We are thinking about you at this dark time.

Truly releases Hot Wing Sauce flavored hard seltzer

Truly Hot Wing Sauce Hot Seltzer was released in a handful of states this week.

If you had to double-check the calendar to see what day it was, so did we. Truly Hot Wing Sauce Hard Seltzer is a thing. This looks like something a brand would post on April Fool’s Day.

Ahead of “The Big Game” Truly debuted a limited edition Hot Wing Sauce flavor, only available online and instantly selling out. Best we can figure, it’s like you dipped your hot wings in a hard seltzer.

Want to take your big game watch party to the next level without shelling out $10,000 on tickets? Truly has you covered with their weirdest, wildest, “who’s ready for some damn football” -est flavor to date: Hot Wing Sauce! This limited edition batch of hard seltzer was created to complete your game-day food spread as the football season comes to a close — get it while it’s hot (or, uhh, cold).

Four 16-ounce cans will run you $24 if there is a re-stock, available to ship in California, Massachusetts, New York, New Jersey, and Florida.

Terrapin Double Red is barrel-aged collaboration heaven

It almost sounds like fiction now, but there was a time in beer when the mere mention of barrel aging would elicit a Pavlovian response. You released it, they would come. Somewhere we lost that.

I’m not sure if it was just a flooded market or style-hype shift. The days of barrel-aged perfection faded for diabetic pastry stouts and chunky lactose haze bombs. In all honesty, I thought those days were gone until I stumbled upon this one.

Terrapin Beer Company has always just done whatever they want to do, stayed true to the mountain biking, travel, solar-powered, live music hippie culture, and just be. Two decades of growth trajectory show it.

Let’s talk about this beer. It’s no secret that Terrapin entered the Miller Coors portfolio years ago, and besides extra capital, it brought new opportunities for collaboration- in this case specifically – Coors Whiskey Company.

David Coors’ interest in whiskey started in college (naturally). He recalls sitting in his father’s (Pete Coors) Suburban on the way to the Coors brewery in Golden, Colorado, and David declared “We should make whiskey!” Without even looking at David, Pete said “We are good at one thing and one thing only, and that’s making beer,” David recalls.

That conversation nagged David for nearly 20 years. In 2019, Coors Brewing Company made the business decision to venture beyond the beer aisle. The time was right to make bourbon, but the question was the approach. He didn’t want to just source juice and slap a label on it. By the time the pandemic hit, Coors had started blending and fell in love with a single malt blended with a bourbon flavor profile that not a lot of people had been releasing.

“We are good at one thing and one thing only, and that’s making beer”

“I was enamored by the flavor profile that came out of it. I was bringing all these different blends to family dinner on Sundays and finally found a blend we settled on and took it to market in 2021,” David says.

Coors Whiskey had recently been doing a barrel-aged imperial porter for AC Golden, piquing a bigger interest in making other barrel-aged beers. They reached out to their various brewery partners. Terrapin immediately jumped in. Brewmaster and co-founder Spike Buckowski and President Dustin Watts loved the whiskey blends. They started by dismissing the idea of putting an imperial stout in the barrel, thinking that’s already been done too much. Rye malt is far and away Spike’s favorite to brew with and dotes heavily on retired Terrapin Big Hoppy Monster (Imperial Rye Ale). Spike used that grain bill to guide the creation of Double Barrel Red Ale.

“The one eye-opening thing was the effect freshly dumped whiskey barrels have on the final flavor. It was so bold on flavor, and big on booze, pushing the final alcohol by volume to 12.7%. I really wanted the red ale to come out of the barrel mimicking the flavors of the 5 Trails blend,” Spike says.

“Having the beer locked and loaded by the time these barrels hit the ground was a challenge for us,” Dustin says. David Coors’ team emptied the barrels and shipped them to Georgia in less than 48 hours. We wanted to be ready to fill,” he adds.

The collaborative result is a liquid flashback to the heyday of barrel-aged beer beauties that we’ve stayed up far too late drinking. Besides conjuring warm fuzzy Big Hoppy Monster flashbacks, Double Barrel marries the best parts of blended whiskey and smooth barrel-aged beer. Terrapin has done a lot of barrel-aged beers in the past but this one stands apart from the others. This wasn’t just “brew a beer and find a barrel,” it was an intentional creation and it shows. It’s a barrel-aged art form we’ve missed.

After the beer was emptied from the barrels, they were shipped back to Coors Whiskey Company who is aging a blend in the barrels, for an ale-finished whiskey coming in late 2024.

Terrapin Double Barrel Red Ale is available in limited 16-ounce cans and draft.

Style: Imperial Red Ale (Barrel Aged. Whiskey)

Hops: Centennial, CTZ, Warrior

Malts: 2-row malt, CaraMalt, Light Crystal, Malted Rye, Amber Malt, Extra light Crystal, Malted Wheat, Flaked Corn

Availability: 16oz Cans, Draft. Limited Release.

12.7% ABV

Great Divide Brewery & Roadhouse 2nd location opens Lone Tree, Colorado in February

Great Divide Brewery and Vibe Concepts will open their second Great Divide Brewing & Roadhouse in February 2024.

Great Divide Brewing & Roadhouse is slated to open in Lone Tree, Colorado in February, marking the brewery’s second “Roadhouse” concept. The first location opened just 13 miles away in Castle Rock, Colorado in May 2020.

Vibe Concepts

Vibe Concepts was founded in 1991 by John, Dan, and Mike Shipp. It is the parent company of Street Roadhouse, Roadhouse Boulder Depot, Spanky’s Road Roadhouse, and Reivers Bar and Grill, founded in 1991. Vibe also has various partnerships with Avery Brewing, Odell Brewing, Dry Dock Brewing, and Ska Brewing.

Great Divide Roadhouse – Take 2

The Lone Tree location is located on the ground floor of the Charles Schwab conference center, in an 8,200 square foot space. The design features a “massive” mahogany bar with a copper ceiling, private dining space for 75, and a four season heated patio.

Executive Chef James Doxon will lead the culinary side of the Roadhouse featuring upscale brewpub fare like burgers, pizzas, steaks and desserts.

Great Divide will not have any on-site brewing, but will have 14 tap handles, including two experimental beers brewed on the 5-Barrel system at the Castle Rock location. Additionally, the location will have more than 25 wines by the bottle, and a well-rounded cocktail menu.

Great Divide Brewery & Roadhouse Castle Rock is located at 9878 Schwab Way #240, Lone Tree Colorado 80124. Open Monday – Friday, 11 a.m. – midnight and Saturday and Sunday 9 a.m. – midnight.

Monday Night Atlanta 404 Lager hits the Peach State soon

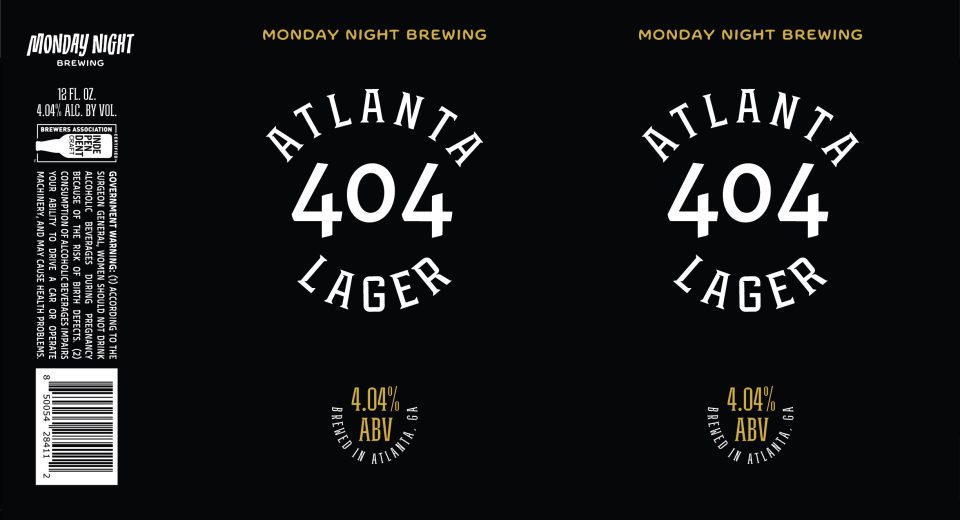

Monday Night Atlanta 404 Lager, a new lower alcohol by volume lager will debut soon from the Atlanta-based brewery.

Monday Night Brewing is prepping a new lager- namely Atlanta 404 Lager, for release in the near future. For context – “404” is Atlanta’s area code. (Think NYC’ s famous 212 area code.)

The lager mot only carries the “404” area code, but is purportedly is also brewed with primarily Georgia grown ingredients.

PIC ARCHIVE: MONDAY NIGHT BREWING

It is the intention of Monday Night to make Atlanta 404 Lager more than a beer. It is important to note that finally plans/details haven’t been finalized- the brewery wants to see a portion of the sales of the 404 set aside to create a “404 Fund” intended to be a financial vessel to give back to the city.

Monday Night Atlanta 404 Lager will be available year round in cans and draft. A release date has not been set.

Style: Lager

Availability: 12oz Cans, Draft. Year-Round

Debut: TBA

4.04% ABV